What a Government Shutdown Really Means for the Housing Market

What a Government Shutdown Really Means for the Housing Market

There’s been a lot of talk about what happens to the housing market during a government shutdown. And if you’re hearing the word “shutdown,” it might sound like everything freezes.

But it doesn’t.

Homes are still being bought and sold. Contracts still get signed. Closings still happen. The market keeps moving. Some parts of the process may slow down a bit, but the real estate world does not stop.

Here’s What Actually Happens

During a shutdown, certain federal agencies either close or reduce staffing. That can create small delays, especially if someone is using a government-backed loan or needs certain insurance approvals. For example:

-

Buyers using FHA, VA, or USDA loans may experience longer processing times.

-

Zillow estimates over 2,500 mortgage applications per workday could face delays during a shutdown.

-

Flood insurance approvals can temporarily pause, which matters for properties in designated flood zones.

Even with those delays, most transactions still move forward. Buyers keep buying. Sellers keep selling. Agents keep guiding their clients through the steps.

And Here’s The Key Part

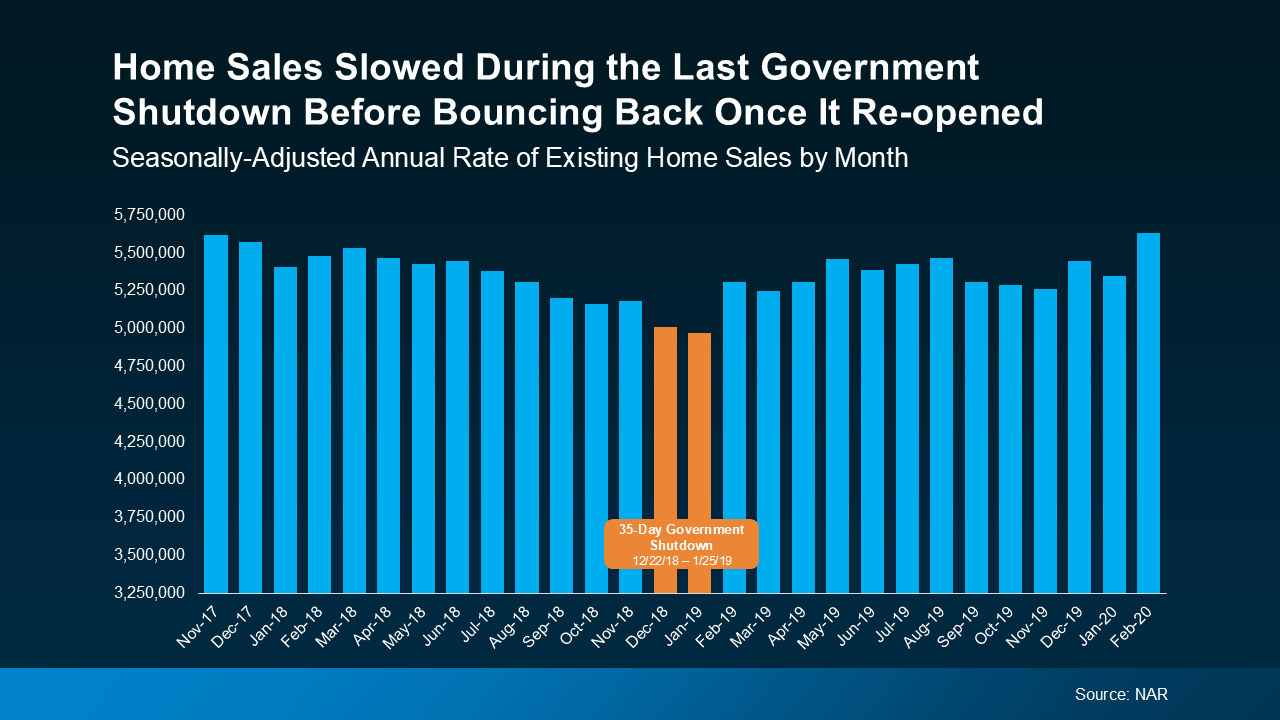

The market usually bounces back quickly. During the most recent shutdown at the end of 2018, home sales dipped slightly, then surged right back once the government reopened. The slowdown was brief and directly tied to the shutdown timeline.

In other words, it wasn’t long-term market damage. It was just a temporary pause.

What This Means for You

If you’re under contract right now, you may see a small delay. Not a deal-breaker. Not a collapse. Just a bump.

Bankrate analyst Jeff Ostrowski puts it well:

“If you’re expecting to close in a week or a month, there could be some slight delay, but for most people, it’s probably going to be a blip more than a real deal killer.”

If you’re just starting to think about buying or selling, there may actually be an advantage here. Many people pause their plans during uncertainty. When others step back, that creates space. Less competition. More negotiation room. Opportunities tend to show up when the crowd hesitates.

Bottom Line

A government shutdown may slow parts of the process, but it does not stop the housing market. Historically, once the government reopens, things pick back up quickly.

If you’re planning to buy or sell and want clarity on how this might affect your timeline, let’s talk through it. I’m here to guide you, answer questions, and help you move forward with confidence.

Data from the National Association of Realtors (NAR) shows existing home sales slowed for about two months, and then rebounded quickly as delayed closings worked their way through the system when the government reopened (see graph below):

What’s important to note is that the slowdown you see

What’s important to note is that the slowdown you see

Categories

Recent Posts